Nonprofit organizations are an integral part of the U.S. economy. These organizations—from museums and social advocacy groups to healthcare providers and universities—can be found across all segments of the economy. To gauge the impact of this sector, the U.S. Bureau of Labor Statistics (BLS) uses its business register, which relies on data from the Quarterly Census of Employment and Wages (QCEW) program, to produce employment, wage, and establishment estimates for nonprofit organizations on a 5-year cycle.1

Although the BLS Business Register contains considerable information about business establishments, it cannot be used to comprehensively identify nonprofit organizations. Thus, to create its nonprofit tabulations, BLS used publicly available data from the Internal Revenue Service (IRS) to identify private-sector nonprofit establishments on the BLS Business Register. Although the IRS lists 29 classifications of tax-exempt entities, BLS restricted its nonprofit tables to the 501(c)(3) category, which identifies charitable and religious organizations.2

For the purposes of this article, the phrase “501(c)(3) establishments” is used interchangeably with the phrase “nonprofit organizations.” Establishments not identified by this approach are labeled as for-profit establishments. However, these for-profit establishments include a small number of tax-exempt organizations that are classified as 501(c) organizations but not as 501(c)(3)s. Tax-exempt businesses that are not 501(c)(3)s include some types of co-ops, civic leagues and social welfare organizations, and domestic fraternal societies.3 Annual estimates are available as a spreadsheet for 2007 to 2017 and can be downloaded from the BLS website.4 Total private and industry data are available at the national, state, metropolitan statistical area, and county levels. Nonprofit statistics for 2018 to 2022 are scheduled to be released in 2024.

This article focuses on employment and establishment tabulations at the national level. This examination of nonprofit data begins by reviewing total private estimates. In 2017, the most recent year of published estimates, 501(c)(3) organizations made up 10 percent of employment and 3 percent of business establishments. An implication of these two statistics is that a nonprofit establishment employs more workers, on average, than does a for-profit establishment.5

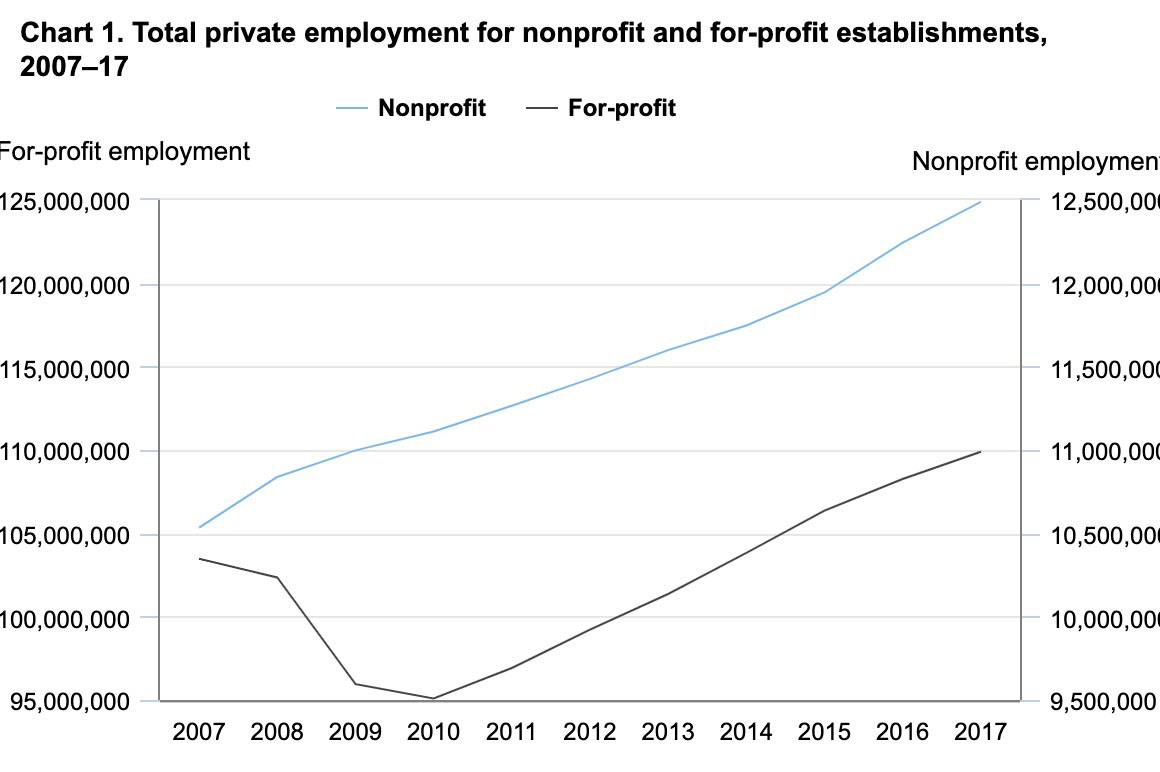

Both nonprofit employment and the number of nonprofit establishments increased steadily for all 11 years of data. These steady increases occurred despite the 2007–09 recession.6 By contrast, for-profit companies saw declines in employment and the number of business establishments during this recession.

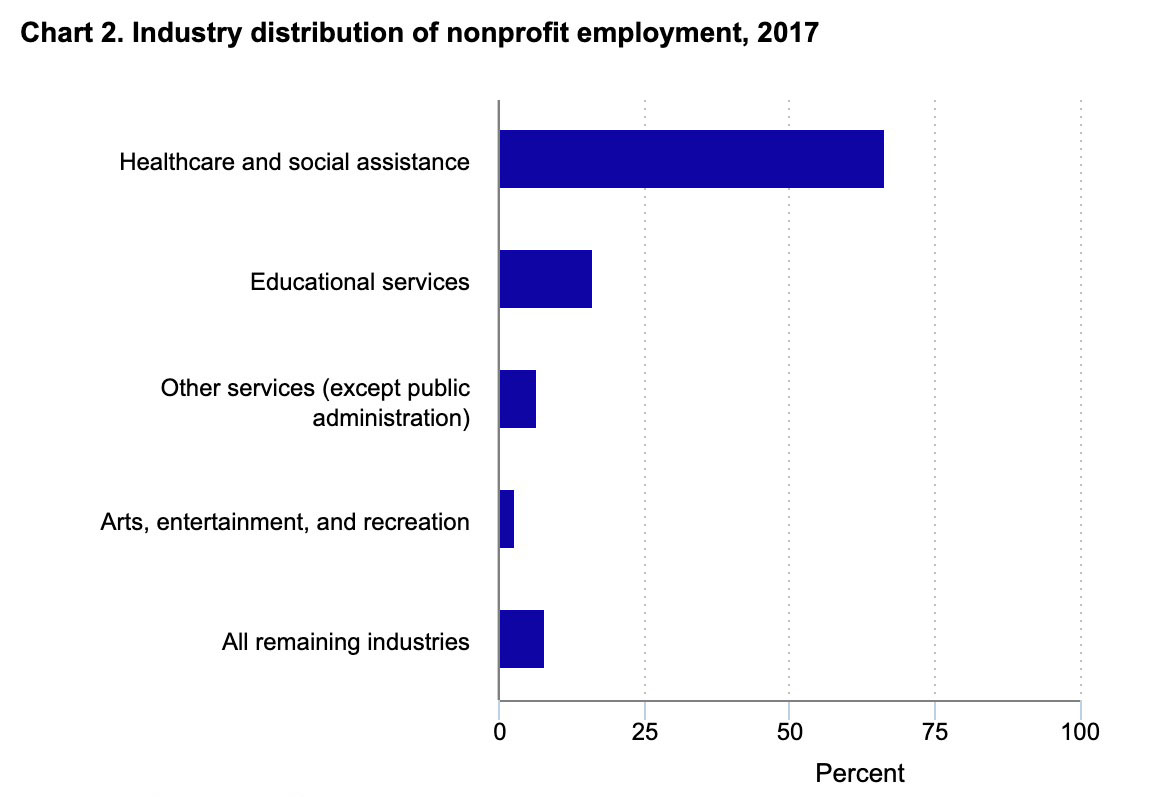

To understand why this is the case, this article delves beyond the total private level and examines the industry composition of 501(c)(3) organizations. Although nonprofit organizations can be found across all segments of the economy, they tend to be concentrated in four industry sectors: healthcare and social assistance; educational services; other services; and arts, entertainment, and recreation.

After reviewing the industry composition of 501(c)(3) organizations, this article examines the distribution of employment between nonprofits and their for-profit counterparts within each industry. Perhaps not surprisingly, the industries in which nonprofits are most prevalent also possess the highest ratios of nonprofit to for-profit employment. In some industries, for example, the proportion of nonprofit jobs relative to for-profit jobs can be as high as 10 to 1.

These industry features provide insight into why nonprofits tend to be large in terms of employment size. Additionally, these same industry features also explain why 501(c)(3) organizations had a steady expansion in employment when for-profit businesses had a decline in employment during the 2007–09 recession.

Highlights at the total private level

Employment and establishment count tabulations for 501(c)(3) organizations are available from 2007 to 2017. These annual estimates depict important differences between nonprofit organizations and their for-profit counterparts.

In 2017, 501(c)(3) organizations made up 10.2 percent of the nation’s private-sector employment (12,488,563 jobs). (See table 1.) In terms of the number of business establishments, however, nonprofits made up only 3.1 percent of the private-sector figure.

| Measure | Nonprofit establishments | For-profit establishments | ||||

|---|---|---|---|---|---|---|

| 2007 | 2017 | Percent change | 2007 | 2017 | Percent change | |

Employment |

10,534,183 | 12,488,563 | 18.6 | 103,478,038 | 109,898,002 | 6.2 |

Average number of establishments |

232,396 | 299,457 | 28.9 | 8,448,605 | 9,237,374 | 9.3 |

Average establishment size |

47 | 42 | [1] | 12 | 12 | [1] |

|

[1] Not applicable. Source: U.S. Bureau of Labor Statistics. |

||||||

Annual changes in employment showed lower variability for nonprofit organizations compared with that of the for-profit segment of the economy. Nonprofit employment grew at a steady pace every year for which there are published estimates, including during the 2007–09 recession. For nonprofits, the largest over-the-year change in total private employment occurred in 2008, when employment increased by 2.9 percent. (See appendix table A-1.) The smallest increase was in 2010, when the total number of nonprofit jobs rose by 1.0 percent. From 2007 to 2010 employment among nonprofits increased by 5.5 percent. Employment at nonprofit organizations was 18.6 percent higher in 2017 than in 2007. (See table 1 and chart 1).

In contrast to the stable employment growth shown by nonprofit organizations, employment growth in the for-profit portion of the economy proved to be more sensitive to economic fluctuations. The effects of the 2007–09 recession can be seen in the employment figures. From 2007 to 2010, total private employment for for-profit businesses fell 8.1 percent, with the greatest annual drop occurring in 2009, when employment fell 6.3 percent. (See appendix table A-1.) As the economy expanded coming out of the recession, from 2010 until 2017, employment in for-profit companies grew 15.6 percent. The largest annual increase occurred in 2015, when employment grew by 2.4 percent. For the full 11-year timeframe (from 2007 to 2017), total private employment increased 6.2 percent. (See table 1 and chart 1).

Comparisons between nonprofits and for-profit firms in terms of the number of business establishments are similar to the comparisons involving employment. The number of 501(c)(3) establishments increased every year from 2007 to 2017, with no slowdown during the 2007–09 recession. From 2007 to 2010, the number of nonprofit establishments grew by 9.4 percent. Coming out of the recession, from 2010 to 2017, the number of 501(c)(3) establishments increased by 17.8 percent. The most rapid annual increase occurred in 2008, when this figure rose by 3.4 percent. (See appendix table A-2.) The slowest growth occurred in 2017, when the number of nonprofit establishments increased by 1.8 percent. From 2007 to 2017, the number of establishments expanded by 28.9 percent. (See table 1 and appendix table A-2.)

The steady increase in the number of nonprofit establishments stands in contrast to the greater variability of for-profit companies. As with employment, the number of for-profit business establishments fell during the recession. From 2007 to 2010, the number of for-profit establishments fell by 0.1 percent. Following the recession, the number of for-profit business establishments increased by 9.4 percent from 2010 to 2017. The largest annual increase took place in 2016, when the number of establishments increased by 2.1 percent. (See table A-2.) From 2007 to 2017, the number of for-profit establishments expanded by 9.3 percent. (See table 1.) For every year of available data, the rate of growth of nonprofit establishments exceeded that of for-profit establishments.

On average, nonprofit establishments tend to have more workers than their for-profit counterparts do. In 2017, nonprofit organizations had, on average, 42 employees per worksite. In contrast, the average number of employees at a for-profit establishment in 2017 was 12, a more than threefold difference in establishment size. (See table 1.)

Understanding why nonprofit establishments have more jobs, on average, than do for-profit establishments requires looking beyond estimates at the total private level and taking into consideration an organization’s economic activity. The next section explores the industry profile of 501(c)(3) organizations and provides insight into this employment size disparity. This industry examination also provides an explanation as to why nonprofits experienced steady employment growth.

Industry nonprofit employment levels

Nonprofit businesses can be classified into a variety of economic activities. One of the many strengths of the nonprofit data is that users can group them by industry. The remainder of this article focuses on the characteristics of 501(c)(3) organizations and for-profit businesses by industry.

Among the 20 industry sectors specified by the North American Industry Classification System (NAICS), BLS did not produce nonprofit estimates for three of these sectors. One of the 20 sectors included in NAICS, public administration, is outside the scope of this project.7 Additionally, BLS did not publish data for utilities or for mining, quarrying, and oil and gas extraction because the number of 503(c)(3) establishments in these two sectors was too low. BLS is required by law to safeguard the confidentiality of its respondents and publishing estimates related to these industries could lead to the release of employer identifiable information.8

Although 501(c)(3) establishments can be found across all segments of the economy, four industry sectors account for about 92 percent of nonprofit jobs. In 2017, the healthcare and social assistance industry (8,306,650 jobs) represented 67 percent of all nonprofit employment. (See chart 2 and appendix table A-3.) The next two largest industries were educational services (2,003,634 jobs) and other services (837,662 jobs), with employment shares of 16 percent and 7 percent, respectively. After these three sectors, the next largest sector, the arts, entertainment, and recreation industry (355,965 jobs) accounted for 3 percent of nonprofit employment. (See chart 2).

For all 11 years of published data, nonprofit employment is concentrated in the same four industry sectors. Additionally, the employment share for each of these four sectors shows little change during this period. For example, the healthcare and social assistance’s share of total nonprofit employment ranged between a low of 67 percent to a high of 68 percent, while educational services varied from 15 percent to 16 percent. The other two major industry sectors showed similar degrees of stability.

Examining the components of these four major industry sectors provides a more detailed picture of this concentration in nonprofit employment. Subsector data, which are at the NAICS three-digit level, are available from 2007 to 2017. With grant funding from the Charles Stewart Mott Foundation and with support from the Center for Civil Society Studies at Johns Hopkins University, BLS published data by industry group, which are at the NAICS four-digit level.9 Industry group tabulations are available for 2013 to 2017.

The healthcare and social assistance sector, the largest nonprofit sector, is made up of four major components. In 2017, the hospital subsector (4,206,764 jobs) accounted for 51 percent of the employment in the healthcare and social assistance sector and for 34 percent of overall nonprofit employment.10 (See table 2 and appendix table A-3.) Within hospitals, most employment was concentrated in the general medical and surgical hospitals industry group (4,031,773 jobs), which includes children’s hospitals, osteopathic hospitals, and general pediatric facilities. The two remaining industry groups are specialty hospitals (129,038 jobs) and psychiatric and substance abuse hospitals (45,943 jobs).

| Industry title | Nonprofit | For-profit | Percent nonprofit |

|---|---|---|---|

Total private |

12,488,563 | 109,898,002 | 10 |

Healthcare and social assistance |

8,306,650 | 11,015,841 | 43 |

Hospitals |

4,206,754 | 811,728 | 84 |

Social assistance |

1,528,920 | 2,190,857 | 41 |

Ambulatory healthcare services |

1,402,007 | 5,856,868 | 19 |

Nursing and residential care facilities |

1,168,968 | 2,156,390 | 35 |

Educational services |

2,003,634 | 820,787 | 71 |

Colleges, universities, and professional schools |

1,137,681 | 104,447 | 92 |

Elementary and secondary schools |

684,170 | 127,242 | 84 |

Other services (except public administration) |

837,662 | 3,597,016 | 19 |

Religious, grantmaking, civic, professional, and similar organizations |

818,562 | 550,983 | 60 |

Arts, entertainment, and recreation |

355,965 | 1,937,907 | 16 |

Museums, historical sites, and similar institutions |

141,289 | 21,972 | 87 |

Amusement, gambling, and recreation industries |

110,595 | 1,536,818 | 7 |

Performing arts, spectator sports, and related industries |

104,081 | 379,118 | 22 |

Source: U.S. Bureau of Labor Statistics. |

|||

The social assistance industry (1,528,920 million jobs) is the next largest subsector of healthcare and social assistance in terms of nonprofit employment. (See table 2.) This diverse industry consists of organizations that focus on local and community involvement. Sixty-six percent of the employment in social assistance was in individual and family services (829,592 jobs). (See appendix table A-3.) Establishments in this industry include drug and alcohol addiction self-help organizations as well as adoption agencies and disability support groups. The remaining 44 percent of social assistance employment is distributed among vocational rehabilitation services (288,693 jobs), child day care services (256,140 jobs), and community food and housing and emergency and other relief services (154,495 jobs).

The second-largest sector in terms of nonprofit employment is educational services. Within this industry, nonprofit jobs were concentrated in two subsectors in 2017—colleges, universities, and professional schools (1,137,681 million jobs) and elementary and secondary schools (684,170 jobs). (See table 2.) Taken together, these two industries were 91 percent of all nonprofit employment in the educational services sector. (See appendix table A-3.) The remaining 9 percent of employment in educational services was distributed across the remaining five industry subsectors—other schools and instruction (82,918 jobs), educational support services (60,153), technical and trade schools (15,493 jobs), business schools and computer management (12,642 jobs), and junior colleges (10,578 jobs).

The other services sector is the third-largest industry in terms of nonprofit employment. In this sector, 98 percent of nonprofit employment is concentrated in the religious, grantmaking, civic, professional, and similar organizations (818,562 jobs) subsector. (See appendix table A-3.) This subsector comprises organizations that promote religious activities, support and advance a variety of causes through grantmaking, and advocate for social and political goals. Some of the other industries found in the other services sector, such as automotive repair and maintenance, deathcare services, and dry cleaning and laundry services, did not have sufficient nonprofit employment to allow publication.

The smallest of the four sectors included in chart 2 is arts, entertainment, and recreation. Within this sector, two industry groups account for 70 percent of all nonprofit employment—museums, historical sites, and similar institutions (141,289 jobs) and other amusement and recreation industries (107,724 jobs). (See table 2.) The other amusement and recreation industries include a diverse range of business ranging from bowling centers to golf clubs and from archery ranges to sailing clubs with marinas. Within the arts, entertainment, and recreation sector, 501(c)(3) organizations can be found among what initially might seem to be unlikely industries. For example, the gambling industries category, which includes casinos and bingo halls, accounted for 1,991 nonprofit jobs in 2017.11 (See appendix table A-3.)

Outside of these four sectors, all remaining industries account for only 8 percent of nonprofit employment. In particular, goods-producing industries, a large segment of total employment in the economy, have relatively few nonprofits. This collection of industries includes construction, manufacturing, and agriculture. Although the goods-producing sector amounts to less than 0.2 percent of all nonprofit employment in 2017, 501(c)(3) establishments can be found throughout a wide variety of subindustries within these sectors. Some of these organizations may be engaged in the construction of low-income housing, the manufacture of Christmas ornaments, or the operation of livestock shows and contests.

Employment distribution within industries

Not only do table 2 and appendix table A-3 show the industries with high levels of nonprofit employment, but they also detail the proportion of employment in nonprofit organizations by industry.

In 2017, 71 percent of educational services jobs were in nonprofits. (See table 2.) Within colleges, universities, and professional schools, 92 percent of jobs were in 501(c)(3) organizations, the highest share within the sector. In elementary and secondary schools, 84 percent of employment was in nonprofit organizations. The remaining five industries within educational services all had nonprofit employment shares less than 50 percent. (See appendix table 3.) The lowest share was in technical and trade schools, in which nonprofits accounted for 14 percent of employment.

In the healthcare and social assistance sector, 43 percent of jobs were in nonprofit organizations. However, this sector-wide figure hides large variability in 501(c)(3) involvement in the subindustries that make up the sector. (See table 2.) For example, 91 percent of jobs in community food and housing and emergency and other relief services were in nonprofit organizations. (See appendix table 3.) By contrast, none of the components of ambulatory healthcare services had a 501(c)(3) share of employment greater than 50 percent. Companies in this subsector typically provide outpatient care across a broad range of health-related services. Offices of dentists showed the lowest proportion of nonprofit employment, not just within this subsector but also in the entire healthcare and social assistance sector. The 9,825 jobs at 501(c)(3) dental offices represented 1 percent of the overall employment in that industry.

Notably, general medical and surgical hospitals, which accounted for nearly half of all 501(c)(3) jobs in the healthcare and social assistance sector, had a large share of nonprofit employment. Just over 86 percent of employment (4,031,773 jobs) was in nonprofit establishments, with the remaining share at for-profit establishments (638,476 jobs).

Within the other services sector, there was a high share of nonprofit employment in religious, grantmaking, civic, professional, and similar organizations. Employment within the five industry groups that compose this subsector were distributed mostly toward nonprofit organizations. The industry with the largest share of nonprofit employment was grantmaking and giving services, in which 92 percent of employment was in 501(c)(3) establishments. (See appendix table A-3.) Included in this industry are charitable trusts, community foundations and health research funding organizations. Some of these organizations may fund a single institution—such as a university, museum, or hospital—or they may opt to support smaller entities or a range of entities. Other industry groups within this subsector with large nonprofit employment shares were social advocacy organizations (88 percent), religious organizations (85 percent), and civic and social organizations (85 percent).

The only industry group in the religious, grantmaking, civic, professional, and similar organizations subsector that did not have most of its employment in nonprofits was business, professional, labor, political, and similar organizations. In this industry group, 14 percent of employment was in 501(c)(3) organizations. (See appendix table A-3.) This group includes establishments involved in promoting the business interests of their members, such as real estate boards, trade associations, and farmers’ unions.

Additionally, sectors with relatively low levels of nonprofit employment also display low shares of nonprofit employment. Outside of the four largest sectors for 501(c)(3) employment, the sector with the highest share of nonprofit employment is management of companies and enterprises. In this sector, nonprofits, which oversee and administer other establishments within their company, accounted for 12 percent of all employment (281,078 jobs) in 2017. (See appendix table A-3.)

Nonprofit employment among goods-producing industries was particularly low. There were no sectors or subsectors with a nonprofit share of employment that exceeded 1 percent. (See appendix table A-3.) Among these industries, the highest share of 501(c)(3) employment was in construction of buildings, an industry in which 0.4 percent of jobs were in nonprofit companies.

Number of establishments and employment size

One of the questions posed at the beginning of this article is why nonprofit organizations tend to have more jobs per establishment on average compared with for-profit companies.12 An examination of the number of business establishments within each industry, combined with the previous discussion on industry employment and the nonprofit share of this employment, provides some insights.

Table 3 specifies the distribution of establishments among both nonprofits and for-profit companies for the major industries discussed in this article. In addition to these establishment figures, the table includes the average number of jobs per establishment.

| Industry | Number of establishments | Average establishment size | ||

|---|---|---|---|---|

| Nonprofit | For-profit | Nonprofit | For-profit | |

Total private |

299,457 | 9,237,374 | 42 | 12 |

Health care and social assistance |

138,319 | 1,393,815 | 60 | 8 |

Hospitals |

5,171 | 4,853 | 814 | 167 |

Social assistance |

67,884 | 784,418 | 23 | 3 |

Ambulatory health care services |

36,058 | 554,580 | 39 | 11 |

Nursing and residential care facilities |

29,205 | 49,965 | 40 | 43 |

Educational services |

32,832 | 84,647 | 61 | 10 |

Elementary and secondary schools |

12,879 | 5,090 | 53 | 25 |

Colleges, universities, and professional schools |

5,331 | 3,603 | 213 | 29 |

Other services (except public administration) |

64,730 | 81,534 | 13 | 5 |

Arts, entertainment, and recreation |

15,261 | 126,241 | 23 | 15 |

Source: U.S. Bureau of Labor Statistics. |

||||

Two themes emerge from this table: First, industries in which nonprofits are prevalent have an average establishment size greater than the national average of 12 jobs. For both the healthcare and social assistance sector and the educational services sector, the average number of jobs per establishment is more than five times greater than the average for their for-profit counterparts. Second, when comparisons are restricted to establishments within the same industry, nonprofit establishments often have more jobs on average than their for-profit counterparts. All the industries shown in table 3, except for nursing and residential care facilities, feature an average employment size for a nonprofit establishment higher than that of a for-profit. In many instances, this size differential is considerable, especially in industries with high levels of nonprofit employment.

The subsectors that comprise the healthcare and social assistance sector illustrate these differences. In the hospital subsector, the largest in terms of nonprofit employment, the average number of jobs at nonprofits was nearly five times higher than at for-profit hospitals. An even greater disparity exists among establishments in social assistance: the average employment size of nonprofit establishments was more than seven times larger than their for-profit peers.

As another example, consider the size difference between the two largest industry groups in the educational services sector. In 2017, a for-profit college or university had an average of 29 jobs. In contrast, the average for nonprofit establishments was over seven times larger, at 213 jobs. (See table 3.) Similarly, employment in an average for-profit elementary or secondary school averaged 25 jobs, while their nonprofit peers averaged 53 jobs.

Most industries with high proportions of nonprofit organizations show similar tendencies. Appendix table A-3 lists all published sectors and the subsectors and industry groups for the four sectors that account for most nonprofit employment. Estimates in this table show that within nearly all listed industries the average employment size for a nonprofit establishment exceeded that of its for-profit counterpart.

In addition, as illustrated in chart 2 and table 3, most nonprofit employment is concentrated in industries characterized by large employers. Two-thirds of nonprofit employment was in the healthcare and social assistance sector, in which the average nonprofit establishment had 60 jobs in 2017. Another 16 percent of 501(c)(3) employment occurred in the educational services sector, in which nonprofit establishments averaged 61 jobs.

In contrast, employment among for-profit companies is more dispersed. Consider the two largest sectors in terms of for-profit employment. The retail trade sector constituted 14 percent of total private employment, and the accommodation and food services sector contributed a 12-percent share. (See appendix table A-3.) For-profit establishments in these two sectors averaged 15 jobs and 20 jobs, respectively.

Industries in which the average employment size is generally large, such as hospitals, make up a considerably smaller portion of for-profit employment than is the case for nonprofits. Specifically, the hospitals subsector made up less than 1 percent of for-profit employment. (See appendix table A-3). By contrast, the ambulatory healthcare services subsector was 53 percent of the employment among for-profit establishments in the healthcare and social assistance sector. This industry group, which includes offices of chiropractors, optometrists, and dentists, tends to be characterized by small-scale employers. The average establishment size among these for-profit businesses was 11.

Similarly, universities and elementary schools—which have large average establishment sizes—contributed much less to overall for-profit employment. The colleges, universities, and professional schools industry group and the elementary and secondary schools industry group each constituted less than 1 percent of total private employment among for-profit businesses.

These industry tabulations reveal why nonprofit establishments are large in terms of employment. Within most industries, nonprofit organizations are larger than their for-profit counterparts. These size differences are amplified by the industry concentration found among nonprofits: most 501(c)(3) organizations are in industries where the average employment size of an establishment is large. Conversely, for-profit businesses are more broadly dispersed throughout the economy, including in many industries in which the employment size is quite small. Taken together, these features provide an explanation as to why nonprofit establishments are considerably larger on average than their for-profit peers.

Looking at employment by industry allows us to explain why nonprofit establishments have more jobs on average than their for-profit counterparts. These same industry estimates can also be used to explain the stable employment growth experienced by nonprofit entities both during and after the 2007–09 recession.

Industry employment growth rates

Employment among nonprofit organizations grew steadily from 2007 to 2017, including during the 2007–09 recession. (See appendix table A-1.) Conversely, employment among for-profit businesses declined during the 2007–09 recession, but then grew faster than did nonprofit employment after the recession.

The noticeable difference in employment growth for nonprofits relative to their for-profit peers reflects their differing industry compositions. Although the nonprofit segment of most sectors had positive employment growth from 2007 to 2017, employment growth was driven by the two largest nonprofit industries.

Nonprofit organizations in the healthcare and social assistance sector experienced employment growth for all 11 years for which data are available.13 The largest over-the-year increase occurred from 2007 to 2008, when the number of jobs in this industry increased by nearly 3 percent. Over the course of the 11 years, nonprofit employment expanded by 16 percent. Like their nonprofit counterparts, for-profit businesses in this sector also experienced employment growth each year from 2007 to 2017, expanding more than their nonprofit counterparts.14

Establishments in the educational services sector also experienced steady employment growth from 2007 to 2017. Both nonprofits and their for-profit peers had positive job growth nearly every year. Among nonprofits in this sector, the number of jobs increased by 21 percent from 2007 to 2017. At the same time, however, employment among non-501(c)(3) companies expanded at a faster rate, 29 percent.

The employment growth in these two sectors explains the steady growth in overall 501(c)(3) employment. As noted in the previous section, 67 percent of nonprofit employment is in healthcare and social assistance and 16 percent is in educational services. Growth in these two sectors from 2007 to 2017, combined with the fact that more than 80 percent of nonprofit jobs are found in these two industries, led to the steady growth in total nonprofit employment over the period.

Although employment in for-profit companies grew in these two sectors, this growth did not lead to steady increases in total private employment. Rather, as shown in chart 1, the 2007–09 recession saw a clear contraction in overall employment among for-profit companies. Whereas the healthcare and social assistance sector and the educational services sector made up 83 percent of nonprofit jobs, these same two sectors constituted only 8 percent of total for-profit employment in 2007. This much smaller share of total private employment diluted the effect of these two industries on overall employment growth.

Also noteworthy is that industries that were more sensitive to the economic downturn of 2007 to 2009 played a small role in nonprofit employment but contributed greatly to for-profit employment. Jobs in construction, manufacturing, and retail trade constitute only a small fraction of the employment at 501(c)(3) organizations yet comprise a significant proportion of for-profit jobs. Among for-profit establishments, all three of these industry sectors experienced large job losses during the 2007–09 recession.

In 2007, the construction, manufacturing, and retail trade sectors were nearly 36 percent of employment for for-profit businesses but less than 1 percent of nonprofit employment. (See appendix table A-3.) As table 4 shows, employment among for-profit companies declined by 27 percent in construction, by 17 percent in manufacturing, and by 7 percent in retail trade.

| Sector | Nonprofit establishments | For-profit establishments | ||||

|---|---|---|---|---|---|---|

| 2007 | 2010 | Percent change | 2007 | 2010 | Percent change | |

Construction |

7,621 | 8,493 | 11 | 7,555,111 | 5,481,006 | -27 |

Manufacturing |

6,656 | 6,732 | 1 | 13,826,366 | 11,480,764 | -17 |

Retail trade |

51,926 | 58,161 | 12 | 15,457,091 | 14,423,163 | -7 |

Source: U.S. Bureau of Labor Statistics. |

||||||

A listing of employment changes in all industry sectors during the recessionary period from 2007 to 2010 is in appendix table A-4. As the table shows, 15 of the 17 listed sectors had declines in employment for the for-profit segment of each industry. The only two sectors to have positive for-profit employment growth were the healthcare and social assistance industry and the educational services industry.

Appendix table A-4 also shows that the nonprofit component of most sectors had positive employment growth from 2007 to 2010; 13 of the 17 published sectors showed an increase in the number of jobs, while 4 had a decrease. These declining industries were information, finance and insurance, wholesale trade, and real estate and rental and leasing. In 2007, these four sectors accounted for about 1 percent of all nonprofit employment and thus had little effect on the overall nonprofit employment trend.

After the recession, most nonprofit sectors experienced positive job growth. As appendix table A-4 shows, from 2010 to 2017, 501(c)(3) organizations experienced positive employment growth in 16 of the 17 published industry sectors. The only sector to see a decline in employment was the real estate and rental and leasing sector. Between 2010 and 2017, total private nonprofit employment increased by 12 percent. Over the same period, for-profit employment grew at a faster rate (16 percent). All industry sectors saw positive employment growth among for-profit businesses, and seven of these sectors grew at a faster rate than their nonprofit counterparts.

Conclusion

The 501(c)(3) nonprofit tabulations created by BLS provide valuable insight into this diverse segment of the economy. Nonprofit organizations display characteristics that are not present among for-profit firms. One notable finding is that nonprofits are concentrated in only a few industries. The healthcare and social assistance sector and the educational services sector account for 83 percent of nonprofit jobs. Among for-profit firms, however, the healthcare and social assistance sector and the educational services sector make up just 11 percent of jobs. Other industries, such as retail trade and construction, are a small portion of employment among nonprofit organizations yet constitute a large portion of employment among for-profit entities.

This nonprofit concentration has important implications. One notable consequence is that nonprofit organizations tend to be large in terms of employment size. Hospitals and universities—which together account for about 4 of every 10 jobs in nonprofit employment—have a higher number of jobs per establishment, on average, than do retail outlets or construction sites.

Another consequence of this concentration can be found in the changes in employment from 2007 to 2017. The 2007–09 recession led to large employment losses. However, the effects of this economic downturn were not evenly spread throughout the economy. While for-profit firms experienced large job losses, nonprofit organizations—which were concentrated in sectors of the economy that fared relatively well during the recession—exhibited steady employment growth during the downturn.

This article focuses on nonprofit estimates at the national level and highlights only some of the characteristics that can be found in the BLS 501(c)(3) data. These data characteristics also include information at the state and county level as well as information on wages at nonprofit organizations. Future analyses of these data could lead to insights about 501(c)(3) organizations at a more granular level.

Appendix

| Year | Nonprofit | For-profit | ||

|---|---|---|---|---|

| Employment | Percent change | Employment | Percent change | |

2007 |

10,534,183 | [1] | 103,478,038 | [1] |

2008 |

10,837,928 | 2.9 | 102,350,715 | -1.1 |

2009 |

10,997,668 | 1.5 | 95,949,436 | -6.3 |

2010 |

11,111,096 | 1.0 | 95,090,136 | -0.9 |

2011 |

11,265,233 | 1.4 | 96,919,562 | 1.9 |

2012 |

11,426,870 | 1.4 | 99,218,999 | 2.4 |

2013 |

11,599,269 | 1.5 | 101,359,065 | 2.2 |

2014 |

11,746,589 | 1.3 | 103,822,097 | 2.4 |

2015 |

11,945,181 | 1.7 | 106,362,536 | 2.4 |

2016 |

12,245,030 | 2.5 | 108,259,592 | 1.8 |

2017 |

12,488,563 | 2.0 | 109,898,002 | 1.5 |

[1] Not applicable. Source: U.S. Bureau of Labor Statistics. |

||||

| Year | Nonprofit | For-profit | ||

|---|---|---|---|---|

| Number of establishments | Percent change | Number of establishments | Percent change | |

2007 |

232,396 | [1] | 8,448,605 | [1] |

2008 |

240,272 | 3.4 | 8,549,088 | 1.2 |

2009 |

247,026 | 2.8 | 8,462,089 | -1.0 |

2010 |

254,236 | 2.9 | 8,441,362 | -0.2 |

2011 |

261,673 | 2.9 | 8,513,984 | 0.9 |

2012 |

267,855 | 2.4 | 8,558,161 | 0.5 |

2013 |

273,333 | 2.0 | 8,638,841 | 0.9 |

2014 |

279,261 | 2.2 | 8,787,948 | 1.7 |

2015 |

286,427 | 2.6 | 8,937,909 | 1.7 |

2016 |

294,064 | 2.7 | 9,123,612 | 2.1 |

2017 |

299,457 | 1.8 | 9,237,374 | 1.2 |

[1] Not applicable. Source: U.S. Bureau of Labor Statistics. |

||||

| Industry | Total private employment | Nonprofit | For-profit | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Employment | Percent of employment | Average establishment size | Employment | Percent of employment | Average establishment size | ||||

| Total private | Sector | Total private | Sector | ||||||

Total private |

122,386,565 | 12,488,563 | 100.0 | [1] | 42 | 109,898,002 | 100.0 | [1] | 12 |

Health care and social assistance |

19,322,491 | 8,306,650 | 66.5 | [1] | 60 | 11,015,841 | 10.0 | [1] | 8 |

Ambulatory healthcare services |

7,258,875 | 1,402,007 | 11.2 | 16.9 | 39 | 5,856,868 | 5.3 | 53.2 | 11 |

Offices of physicians |

2,572,041 | 653,456 | 5.2 | 7.9 | 39 | 1,918,585 | 1.7 | 17.4 | 10 |

Offices of dentists |

933,738 | 9,825 | 0.1 | 0.1 | 18 | 923,913 | 0.8 | 8.4 | 7 |

Offices of other health practitioners |

886,112 | 43,264 | 0.3 | 0.5 | 20 | 842,848 | 0.8 | 7.7 | 6 |

Outpatient care centers |

889,352 | 396,544 | 3.2 | 4.8 | 37 | 492,808 | 0.4 | 4.5 | 20 |

Medical and diagnostic laboratories |

269,282 | 22,752 | 0.2 | 0.3 | 50 | 246,530 | 0.2 | 2.2 | 12 |

Home healthcare services |

1,407,028 | 190,154 | 1.5 | 2.3 | 73 | 1,216,874 | 1.1 | 11.0 | 38 |

Other ambulatory healthcare services |

301,323 | 86,012 | 0.7 | 1.0 | 30 | 215,311 | 0.2 | 2.0 | 21 |

Hospitals |

5,018,482 | 4,206,754 | 33.7 | 50.6 | 814 | 811,728 | 0.7 | 7.4 | 167 |

General medical and surgical hospitals |

4,670,249 | 4,031,773 | 32.3 | 48.5 | 892 | 638,476 | 0.6 | 5.8 | 241 |

Psychiatric and substance abuse hospitals |

118,991 | 45,943 | 0.4 | 0.6 | 167 | 73,048 | 0.1 | 0.7 | 84 |

Specialty (except psychiatric and substance abuse) hospitals |

229,242 | 129,038 | 1.0 | 1.6 | 341 | 100,204 | 0.1 | 0.9 | 75 |

Nursing and residential care facilities |

3,325,358 | 1,168,968 | 9.4 | 14.1 | 40 | 2,156,390 | 2.0 | 19.6 | 43 |

Nursing care facilities (skilled nursing facilities) |

1,617,065 | 361,827 | 2.9 | 4.4 | 130 | 1,255,238 | 1.1 | 11.4 | 84 |

Residential intellectual and developmental disability, mental health |

624,987 | 415,031 | 3.3 | 5.0 | 22 | 209,956 | 0.2 | 1.9 | 22 |

Continuing care retirement communities and assisted living facilities |

918,205 | 280,092 | 2.2 | 3.4 | 81 | 638,113 | 0.6 | 5.8 | 28 |

Other residential care facilities |

165,101 | 112,019 | 0.9 | 1.3 | 30 | 53,082 | 0.0 | 0.5 | 18 |

Social assistance |

3,719,777 | 1,528,920 | 12.2 | 18.4 | 23 | 2,190,857 | 2.0 | 19.9 | 3 |

Individual and family services |

2,341,858 | 829,592 | 6.6 | 10.0 | 24 | 1,512,266 | 1.4 | 13.7 | 2 |

Community food and housing, and emergency and other relief services |

169,361 | 154,495 | 1.2 | 1.9 | 16 | 14,866 | 0.0 | 0.1 | 10 |

Vocational rehabilitation services |

335,404 | 288,693 | 2.3 | 3.5 | 42 | 46,711 | 0.0 | 0.4 | 18 |

Child day care services |

873,154 | 256,140 | 2.1 | 3.1 | 15 | 617,014 | 0.6 | 5.6 | 11 |

Educational services |

2,824,421 | 2,003,634 | 16.0 | [1] | 61 | 820,787 | 0.7 | [1] | 10 |

Elementary and secondary schools |

811,412 | 684,170 | 5.5 | 34.1 | 53 | 127,242 | 0.1 | 15.5 | 25 |

Junior colleges |

27,952 | 10,578 | 0.1 | 0.5 | 52 | 17,374 | 0.0 | 2.1 | 26 |

Colleges, universities, and professional schools |

1,242,128 | 1,137,681 | 9.1 | 56.8 | 213 | 104,447 | 0.1 | 12.7 | 29 |

Business schools and computer and management training |

67,466 | 12,642 | 0.1 | 0.6 | 11 | 54,824 | 0.0 | 6.7 | 6 |

Technical and trade schools |

110,321 | 15,493 | 0.1 | 0.8 | 13 | 94,828 | 0.1 | 11.6 | 11 |

Other schools and instruction |

419,343 | 82,918 | 0.7 | 4.1 | 12 | 336,425 | 0.3 | 41.0 | 7 |

Educational support services |

145,799 | 60,153 | 0.5 | 3.0 | 12 | 85,646 | 0.1 | 10.4 | 7 |

Other services (except public administration) |

4,434,678 | 837,662 | 6.7 | [1] | 13 | 3,597,016 | 3.3 | [1] | 5 |

Repair and maintenance |

1,305,012 | 1,126 | 0.0 | 0.1 | 6 | 1,303,886 | 1.2 | 36.2 | 6 |

Personal and laundry services |

1,471,650 | 17,462 | 0.1 | 2.1 | 11 | 1,454,188 | 1.3 | 40.4 | 7 |

Religious, grantmaking, civic, professional, and similar organizations |

1,369,545 | 818,562 | 6.6 | 97.7 | 13 | 550,983 | 0.5 | 15.3 | 7 |

Religious organizations |

191,664 | 162,772 | 1.3 | 19.4 | 9 | 28,892 | 0.0 | 0.8 | 6 |

Grantmaking and giving services |

143,416 | 131,273 | 1.1 | 15.7 | 9 | 12,143 | 0.0 | 0.3 | 6 |

Social advocacy organizations |

211,659 | 185,370 | 1.5 | 22.1 | 10 | 26,289 | 0.0 | 0.7 | 6 |

Civic and social organizations |

392,218 | 279,738 | 2.2 | 33.4 | 31 | 112,480 | 0.1 | 3.1 | 7 |

Business, professional, labor, political, and similar organizations |

430,587 | 59,409 | 0.5 | 7.1 | 11 | 371,178 | 0.3 | 10.3 | 7 |

Private households |

288471 | 511 | 0.0 | 0.1 | 2 | 287960 | 0.3 | 8.0 | 1 |

Arts, entertainment, and recreation |

2,293,872 | 355,965 | 2.9 | [1] | 23 | 1,937,907 | 1.8 | [1] | 15 |

Performing arts, spectator sports, and related industries |

483,199 | 104,081 | 0.8 | 29.2 | 18 | 379,118 | 0.3 | 19.6 | 8 |

Performing arts companies |

122,891 | 70,103 | 0.6 | 19.7 | 20 | 52,788 | 0.0 | 2.7 | 8 |

Spectator sports |

141,877 | 3,509 | 0.0 | 1.0 | 12 | 138,368 | 0.1 | 7.1 | 23 |

Promoters of performing arts, sports, and similar events |

141,120 | 28,692 | 0.2 | 8.1 | 17 | 112,428 | 0.1 | 5.8 | 18 |

Agents and managers for artists, athletes, entertainers, and public figures |

26699 | 229 | 0.0 | 0.1 | 5 | 26470 | 0.0 | 1.4 | 6 |

Independent artists, writers, and performers |

50,611 | 1,548 | 0.0 | 0.4 | 4 | 49,063 | 0.0 | 2.5 | 2 |

Museums, historical sites, and similar institutions |

163,261 | 141,289 | 1.1 | 39.7 | 28 | 21,972 | 0.0 | 1.1 | 15 |

Museums, historical sites, and similar institutions |

163,261 | 141,289 | 1.1 | 39.7 | 28 | 21,972 | 0.0 | 1.1 | 15 |

Amusement, gambling, and recreation industries |

1,647,413 | 110,595 | 0.9 | 31.1 | 25 | 1,536,818 | 1.4 | 79.3 | 20 |

Amusement parks and arcades |

211474 | 879 | 0.0 | 0.2 | 31 | 210595 | 0.2 | 10.9 | 68 |

Gambling industries |

122,414 | 1,991 | 0.0 | 0.6 | 11 | 120,423 | 0.1 | 6.2 | 39 |

Other amusement and recreation industries |

1,313,524 | 107,724 | 0.9 | 30.3 | 26 | 1,205,800 | 1.1 | 62.2 | 17 |

Management of companies and enterprises |

2,278,042 | 281,078 | 2.3 | [1] | 61 | 1,996,964 | 1.8 | [1] | 33 |

Professional, scientific, and technical services |

8,996,430 | 270,133 | 2.2 | [1] | 23 | 8,726,297 | 7.9 | [1] | 7 |

Administrative and support and waste management and remediation services |

9,064,811 | 100,918 | 0.8 | [1] | 20 | 8,963,893 | 8.2 | [1] | 17 |

Retail trade |

15,854,454 | 93,484 | 0.7 | [1] | 16 | 15,760,970 | 14.3 | [1] | 15 |

Information |

2,793,429 | 68,057 | 0.5 | [1] | 14 | 2,725,372 | 2.5 | [1] | 17 |

Finance and insurance |

5,908,709 | 43,734 | 0.4 | [1] | 34 | 5,864,975 | 5.3 | [1] | 12 |

Accommodation and food services |

13,606,761 | 38,065 | 0.3 | [1] | 20 | 13,568,696 | 12.3 | [1] | 20 |

Real estate and rental and leasing |

2,179,696 | 36,433 | 0.3 | [1] | 9 | 2,143,263 | 2.0 | [1] | 6 |

Transportation and warehousing |

4,947,369 | 21,229 | 0.2 | [1] | 24 | 4,926,140 | 4.5 | [1] | 20 |

Construction |

6,919,107 | 9,270 | 0.1 | [1] | 10 | 6,909,837 | 6.3 | [1] | 9 |

Manufacturing |

12,406,757 | 7,464 | 0.1 | [1] | 28 | 12,399,293 | 11.3 | [1] | 36 |

Wholesale trade |

5,898,637 | 3,985 | 0.0 | [1] | 5 | 5,894,652 | 5.4 | [1] | 10 |

Agriculture, forestry, fishing, and hunting |

1,261,312 | 2,976 | 0.0 | [1] | 9 | 1,258,336 | 1.1 | [1] | 12 |

[1] Not applicable. Note: Percentages may not sum to totals because of rounding. Source: U.S. Bureau of Labor Statistics. |

|||||||||

| Industry | 2007–2010 | 2010–17 | 2007–17 | |||

|---|---|---|---|---|---|---|

| Nonprofit | For-profit | Nonprofit | For-profit | Nonprofit | For-profit | |

Total private |

5 | -8 | 12 | 16 | 19 | 6 |

Healthcare and social assistance |

6 | 8 | 10 | 28 | 16 | 37 |

Hospitals |

5 | 0 | 6 | 24 | 10 | 24 |

Social assistance |

7 | 10 | 10 | 103 | 18 | 124 |

Nursing and residential care facilities |

3 | 8 | -1 | 11 | 3 | 20 |

Ambulatory healthcare services |

15 | 8 | 37 | 18 | 58 | 28 |

Educational services |

4 | 17 | 17 | 10 | 21 | 29 |

Other services (except public administration) |

1 | -3 | 9 | 0 | 11 | -2 |

Religious, grantmaking, civic, professional, and similar organizations |

1 | -5 | 9 | -2 | 10 | -6 |

Arts, entertainment, and recreation |

8 | -4 | 29 | 19 | 39 | 14 |

Museums, historical sites, and similar institutions |

1 | 0 | 27 | 34 | 28 | 33 |

Performing arts, spectator sports, and related industries |

-1 | -3 | 18 | 24 | 16 | 19 |

Amusement, gambling, and recreation industries |

35 | -4 | 45 | 18 | 96 | 13 |

Professional, scientific, and technical services |

7 | -3 | 7 | 21 | 15 | 18 |

Management of companies and enterprises |

16 | -1 | 44 | 20 | 67 | 19 |

Administrative and support and waste management and remediation services |

3 | -12 | 32 | 22 | 36 | 8 |

Information |

-2 | -11 | 7 | 3 | 5 | -8 |

Retail trade |

12 | -7 | 61 | 9 | 80 | 2 |

Finance and insurance |

-35 | -8 | 72 | 7 | 12 | -1 |

Real estate and rental and leasing |

-3 | -11 | -2 | 14 | -5 | 1 |

Accommodation and food Services |

10 | -2 | 20 | 23 | 32 | 20 |

Transportation and warehousing |

16 | -8 | 24 | 25 | 44 | 15 |

Construction |

11 | -27 | 9 | 26 | 22 | -9 |

Manufacturing |

1 | -17 | 11 | 8 | 12 | -10 |

Wholesale trade |

-3 | -9 | 0 | 8 | -3 | -1 |

Agriculture, forestry, fishing and hunting |

19 | -2 | 71 | 10 | 104 | 8 |

Source: U.S. Bureau of Labor Statistics. |

||||||

Erik Friesenhahn, "Nonprofits: a look at national trends in establishment size and employment," Monthly Labor Review, U.S. Bureau of Labor Statistics, January 2024, https://doi.org/10.21916/mlr.2024.2

Notes

1 Many nonprofit organizations rely heavily or entirely on volunteer workers. However, only paid employment is included in the tabulations discussed in this article. The U.S. Bureau of Labor Statistics (BLS) Business Register is based on unemployment insurance reports filed by employers, and only paid employees are included in these reports.

2 For more information about publicly available Internal Revenue Service (IRS) data, see “Exempt Organizations Business Master File extract” (Internal Revenue Service, last modified October 15, 2023), https://www.irs.gov/charities-non-profits/exempt-organizations-business-master-file-extract-eo-bmf. For a detailed discussion of the methodology and data sources used to create these estimates, see Erik Friesenhahn, “Nonprofit organizations using the BLS Business Register to measure employment, wages, and establishment size,” Monthly Labor Review, November 2023, https://doi.org/10.21916/mlr.2023.27.

3 For more information, see “Other Tax-Exempt Organizations” (Internal Revenue Service, last modified March 7, 2023), https://www.irs.gov/charities-non-profits/other-tax-exempt-organizations.

4 For more information on nonprofits and how BLS classifies them, see “Research Data on the Nonprofit Sector,” Business Employment Dynamics (U.S. Bureau of Labor Statistics, last modified May 14, 2020), https://www.bls.gov/bdm/nonprofits/nonprofits.htm.

5 There are administrative reasons that cause BLS tabulations for nonprofit organizations to have a larger employment size than for-profit establishments. Some states do not require nonprofit organizations with fewer than 5employees to file unemployment insurance reports. Because the BLS Business Register is based on unemployment insurance reports, BLS estimates of nonprofit establishment size are overstated in states that do not require small nonprofits to file. However, BLS analyses indicate that the effect is small. The estimated undercount of the total number of nonprofit establishments is somewhat larger and leads to an increased average establishment size for nonprofits. An examination of these issues is presented in Friesenhahn, “Nonprofit organizations.”

6 For more information, see “U.S. business cycle expansions and contractions” (National Bureau of Economic Research, last updated March 14, 2023), https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions.

7 BLS, like other federal statistical agencies, uses the North American Industrial Classification System (NAICS) to categorize business establishments into industry groupings. In doing so this classification method provides a uniform process by which to identify and tabulate business activity across the economy. NAICS is a hierarchical system in which each successive layer of detail provides greater insight into an establishment’s business activity. A benefit of this approach is that it allows data users to partition each industry into its component parts and analyze data at a more granular level. In NAICS codes, two digits denotes sector, three digits subsector, four digits industry group, five digits industry, and six digits denotes country of origin. Data users interested in learning more about this classification system can find in-depth information at “North American Industry Classification System” (U.S. Census Bureau, last modified October 24, 2023), https://www.census.gov/naics/.

8 For more information about the confidentiality requirements of BLS, see “Confidentiality pledge and laws” (U.S. Bureau of Labor Statistics, last modified April 3, 2020), https://www.bls.gov/bls/confidentiality.htm.

9 For more information on these data, see “Research Data on the Nonprofit Sector,” Business Employment Dynamics (U.S. Bureau of Labor Statistics, last modified May 14, 2020), https://www.bls.gov/bdm/nonprofits/nonprofits.htm.

10 Note that the nonprofit data include only private-sector hospitals.

11 The IRS permits gambling and other gaming activities by nonprofits under certain circumstances. For a detailed discussion of permissible gaming and gambling activities that a 501(c)(3) nonprofit may engage in, see “Gaming and Gambling Rules for 501(c)(3) Nonprofit Fundraising” Form1023 (website), last updated November 6, 2023, https://form1023.org/gaming-gambling-rules-for-501c3-nonprofit-fundraising.

12 Differing reporting requirements among states lead to an undercount of small nonprofit establishments. Because some small nonprofit establishments are excluded from the BLS Business Register, the average establishment size is somewhat higher than if these establishments had been included. This effect is most pronounced in industries in which establishment sizes tend to be small, most notably the religious, grantmaking, civic, professional, and similar organizations subsector. However, even when taking the reporting difference into account, the average establishment size for nonprofits is generally considerably higher than for for-profit organizations. For more information, see Friesenhahn, “Nonprofit organizations.”

13 For a thorough discussion of employment growth in the healthcare industry , see Catherine A. Wood, “Employment in health care: a crutch for the ailing economy during the 2007–09 recession,” Monthly Labor Review, April 2011, pp. 13–18, https://www.bls.gov/opub/mlr/2011/04/art2full.pdf.

14 From 2007 to 2017, measured employment among for-profit companies in the healthcare and social assistance industry expanded by 37 percent. However, the large increase in 2013 can mostly be attributed to an administrative change in the way certain records were processed. This change affected data tabulations for business establishments classified in the services for the elderly and persons with disabilities industry (NAICS 624120) and the private households industry (NAICS 814110). A review of administrative records revealed that certain establishments that provide nonmedical, home-based services for the elderly and persons with disabilities had been misclassified into the private households industry. To correct this matter, these records were reclassified into the services for the elderly and persons with disabilities industry. This correction led to a large employment increase in the 2013 estimates for services for the elderly and persons with disabilities and a decrease in employment for private households. This administrative change does not account for all the employment growth in the healthcare and social assistance sector in 2013 and does not change the overall strong upward trend in employment for this sector from 2007 to 2017. Furthermore, the over-the-year growth rate of employment for for-profit establishments was greater than that of their nonprofit counterparts for all years of data.

Article Courtesy US Bureau of Labor and Statistics